International Flavors To Report Q4 Earnings: What's In Store?

International Flavors & Fragrances Inc. IFF is scheduled to report fourth-quarter 2025 results on Feb. 11, after the closing bell.

The Zacks Consensus Estimate for sales is pegged at $2.51 billion, indicating a 9.7% dip from the year-ago reported figure.

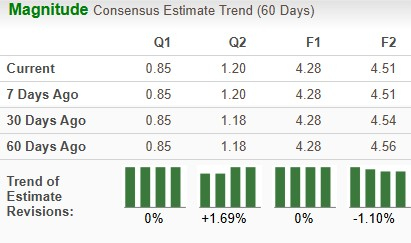

The Zacks Consensus Estimate for earnings is pegged at 85 cents per share, which has remained unchanged in the past 60 days. The estimate indicates a year-over-year decline of 12.4%.

Image Source: Zacks Investment Research

IFF’s Earnings Surprise History

International Flavors’ earnings beat the Zacks Consensus Estimates in each of the trailing four quarters, the average beat being 9.5%.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

What the Zacks Model Unveils for International Flavors

Our model predicts an earnings beat for International Flavors this time around. The combination of a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. That is precisely the case here.

Earnings ESP: IFF has an Earnings ESP of+3.50%. You can uncover the best stocks before they are reported with our Earnings ESP Filter.

Zacks Rank: The company currently carries a Zacks Rank of 3.

Factors Likely to Have Shaped IFF’s Q4 Performance

The company has been witnessing volume growth, with broad-based contributions across each of its businesses. International Flavors’ results are likely to reflect the impacts of the overall improvement in its sales performance. IFF’s ongoing efforts to improve productivity and reduce costs are likely to have benefited its margins.

However, International Flavors has been incurring high raw material costs and additional costs related to labor, shipping and cleaning.

Despite its pricing actions and focused cost-reduction efforts, these factors are likely to have dented margins in the to-be-reported quarter. The company’s manufacturing costs are expected to have increased to support higher demand.

Projections for International Flavors’ Segments in Q4

In May 2025, the company divested its Pharma Solutions segment. At the beginning of the first quarter of 2025, the company separated its Nourish segment into the Taste and Food Ingredients segments. Post these adjustments, the company currently has four business divisions — Taste, Food Ingredients, Health & Bioscience, and Scent.

Our model estimates the Taste segment’s fourth-quarter sales to dip 0.8% year over year to $572 million. The segment’s adjusted operating EBITDA is projected to be $113 million, indicating growth of 29.3% from the year-ago quarter’s reported numbers.

Our model estimates the Food Ingredient’s fourth-quarter sales to fall 2.7% year over year to $797 million. The segment’s adjusted operating EBITDA is estimated to be $98 million, indicating a decline of 2.7% from the year-ago figure.

We expect the Scent segment’s sales to decrease 2% year over year to $567 million. The ongoing momentum in Consumer Fragrance, as well as improvement in Fragrance Ingredients and Fine Fragrance, is likely to have aided its performance. However, the gains might have been partially negated by higher costs. Our estimate for the segment’s quarterly operating EBITDA is $107 million, indicating a year-over-year rise of 1%.

The Health & Biosciences segment’s sales are projected to be $542 million, indicating a 1.5% decrease from the year-ago quarter’s reported figure. We expect operating EBITDA to decrease 4% to $131 million.

IFF Stock’s Price Performance

In the past year, IFF shares have lost 9.1% against the industry’s 1.7% growth.

Image Source: Zacks Investment Research

Image Source: Zacks Investment Research

Other Stocks to Consider

Here are some other Basic Materials stocks, which, according to our model, also have the right combination of elements to post an earnings beat in their upcoming releases.

Agnico Eagle Mines Limited AEM, scheduled to release fourth-quarter 2025 earnings on Feb. 12, currently has an Earnings ESP of +6.14% and a Zacks Rank of 3. You can see the complete list of today’s Zacks #1 Rank stocks here.

Agnico Eagle Mines’ earnings for the fourth quarter are pegged at $2.19 per share, indicating a year-over-year jump of 73.8%. The company delivered a trailing four-quarter average earnings surprise of 11.6%.

Pan American Silver Corp. PAAS, slated to release fourth-quarter 2025 earnings on Feb. 18, has an Earnings ESP of +1.36% and a Zacks Rank of 3 at present.

The Zacks Consensus Estimate for Pan American Silver’s earnings is pegged at 86 cents per share, which indicates a significant climb from the year-ago figure of 35 cents. Pan American Silver delivered a trailing four-quarter average earnings surprise of 31.6%.

Kinross Gold Corporation KGC, slated to release fourth-quarter 2025 earnings on Feb. 18, has an Earnings ESP of +8.68% and a Zacks Rank of 3 at present.

The consensus mark for Kinross Gold’s earnings is pegged at 56 cents per share, implying a year-over-year rise of 180%. Kinross Gold delivered a trailing four-quarter average earnings surprise of 17.4%.

Zacks Names #1 Semiconductor Stock

This under-the-radar company specializes in semiconductor products that titans like NVIDIA don't build. It's uniquely positioned to take advantage of the next growth stage of this market. And it's just beginning to enter the spotlight, which is exactly where you want to be.

With strong earnings growth and an expanding customer base, it's positioned to feed the rampant demand for Artificial Intelligence, Machine Learning, and Internet of Things. Global semiconductor manufacturing is projected to explode from $452 billion in 2021 to $971 billion by 2028.

See This Stock Now for Free >>Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

International Flavors & Fragrances Inc. (IFF): Free Stock Analysis Report

Kinross Gold Corporation (KGC): Free Stock Analysis Report

Agnico Eagle Mines Limited (AEM): Free Stock Analysis Report

Pan American Silver Corp. (PAAS): Free Stock Analysis Report

This article originally published on Zacks Investment Research (zacks.com).

Popular Products

-

Put Me Down Funny Toilet Seat Sticker

Put Me Down Funny Toilet Seat Sticker$33.56$16.78 -

Stainless Steel Tongue Scrapers

Stainless Steel Tongue Scrapers$33.56$16.78 -

Stylish Blue Light Blocking Glasses

Stylish Blue Light Blocking Glasses$85.56$42.78 -

Adjustable Ankle Tension Rope

Adjustable Ankle Tension Rope$53.56$26.78 -

Electronic Bidet Toilet Seat

Electronic Bidet Toilet Seat$981.56$490.78