Investors See Assisted Living, Active Adult As Best Bets, Pricing Returning To Equilibrium

Senior living investors are still favoring assisted living properties in 2026 as valuations surge, but there are signs that community pricing is returning closer to equilibrium.

That’s according to a new Cushman & Wakefield survey analyzing market conditions in the first half of 2026. The report, released Feb. 6, is based on responses from more than 75 senior living and care professionals.

At the start of a new year, the senior living industry has the wind to its back with regard to demand. Senior living occupancy is nearing 90% in 2026 after net absorption outpaced supply growth by 4.8 to 1 in 2025, according to NIC MAP data cited by the report’s authors. Consolidation, adopting new technology and a “slight softening” in labor markets helped operators strengthen margins last year.

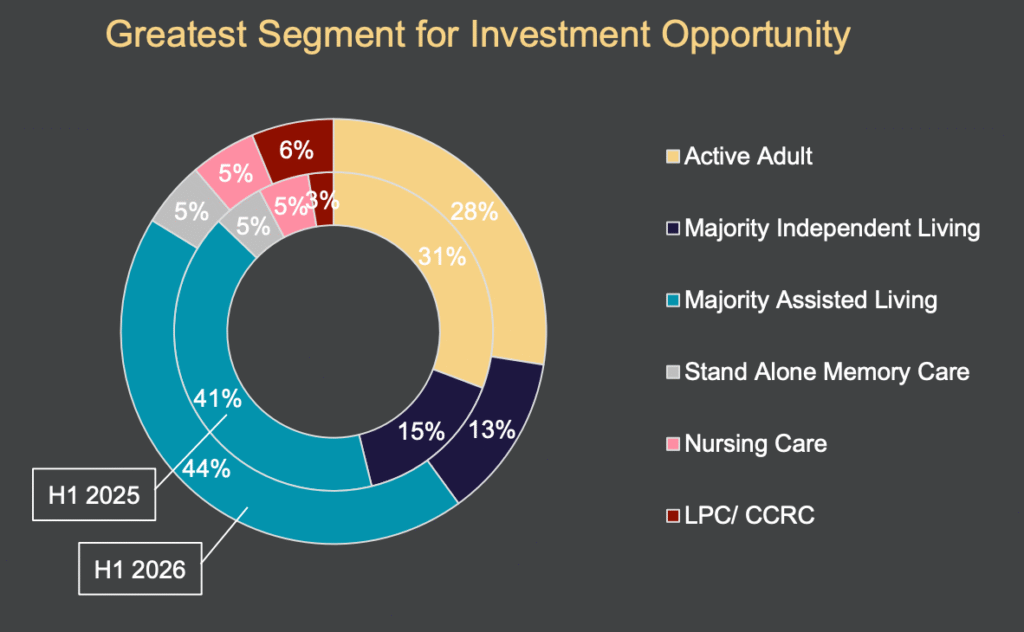

Investors are in 2026 favoring assisted living, with 44% identifying the product type as their top investment opportunity in 2026, representing a slight gain over 2025, when 41% of respondents said the same. More than a quarter of the survey’s respondents (28%) fingered active adult as their top opportunity for investment, representing a slight decrease over the previous year.

Half of respondents in the latest survey see core-plus acquisitions as their most compelling investment strategy, while 28% said the same about value-add acquisitions. Almost three-fourths of the respondents (72%) said they were not willing to underwrite negative leverage, a stark gain over last year, when 48% said the same.

“Though opportunistic/distressed strategies are still sought out by investors, limited opportunity for this strategy has materialized, due to lender workouts and favorable property market performance,” the survey’s authors wrote. “The survey results further indicate a significant reduction of negative leverage in investor underwriting, signaling that pricing is beginning to return to equilibrium, driven by favorable property market trends with increased NOI and a more favorable cost of capital.”

More than a third (37%) of the respondents see staffing as a top risk to valuations in the next 12 months, while more than a quarter (29%) said the same about interest rates. At the same time, 71% of respondents said they think cap rates will decrease in the coming 12 months.

“Not only is this a strong indication that valuations have bottomed, survey results further indicate the return of investor confidence in the sector,” the report’s authors wrote.

The return of fresh capital and a general increase in debt liquidity is driving “a very competitive investment market for the sector,” and “signaling a swift shift from a buyer’s market to a seller’s market.”

The post Investors See Assisted Living, Active Adult as Best Bets, Pricing Returning to Equilibrium appeared first on Senior Housing News.

Popular Products

-

Waterproof Bathroom Storage Cabinet

Waterproof Bathroom Storage Cabinet$228.99$159.78 -

Wall-Mount Metal Clothes Rack Vintage...

Wall-Mount Metal Clothes Rack Vintage...$126.99$87.78 -

Modern Shoe Cabinet with Doors

Modern Shoe Cabinet with Doors$436.99$304.78 -

Portable Ceramic Space Heater

Portable Ceramic Space Heater$181.99$126.78 -

Smart Top-Fill Cool Mist Humidifier

Smart Top-Fill Cool Mist Humidifier$257.99$179.78