Senior Living Industry Gets ‘smarter’ About Development While Waiting For Next Supply Cycle

This story is part of your SHN+ subscription

In 2026, senior living development activity remains on the fringes, with few signs that will change any time soon. But growth via new-build is now at least on the mind of investors and capital partners as demand for senior living swells.

Operators are as a result growing in places “you can’t even find on the map” and working with well-established internal development wings to secure sites for expansion.

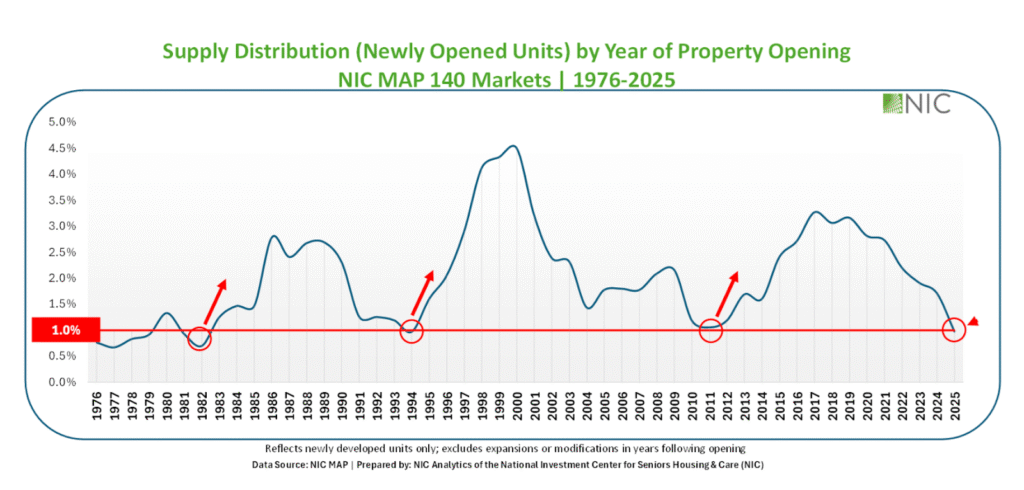

National Investment Center for Seniors Housing & Care (NIC) Senior Principal Omar Zahraoui noted that the industry is in the “early innings of the next supply cycle.” Investors, owners and developers of new projects are focused on “trying to catch up” to demand rather than getting ahead of it, as they did during its most recent development cycle between 2011 and 2019.

Rather than a “build it and they will come” mentality, senior living development in 2026 and beyond will be a “prove it before you build mentality,” Zahraoui told me.

As he pointed out last year at BUILD, history shows that when new inventory growth falls to approximately 1% of total senior living properties, a new development cycle is likely to occur within five years.

Senior living companies have learned from previous cycles and thus are not in the mindset of “build it and they will come,” according to Senior Living Investment Brokerage Senior Managing Director Ryan Saul. Instead, they are relying on past development relationships and putting greater emphasis on market research, along with specific unit mixes.

“The industry is getting a lot smarter in what projects the market can bear,” he said.

For years, a high cost of development and a relatively low cost of acquisitions compared to replacement has pushed senior living owners to buy instead of build. In 2026, some “keystone deals” are transacting at or above replacement costs, Richard Swartz, JLL’s senior housing platform co-leader, told me last month. If that trend continues, it’s a sign that new development will become more favorable from a financial cost basis.

Of course, even if new projects are started today, they face a timeline of more than two years to completion. So, even if the development ramp-up occurs in 2026, those communities won’t substantially open until 2028. But any sign of a development pickup will come as good news in light of the senior living industry’s ever-widening “investment gap” of short supply and rising demand.

In this week’s exclusive, SHN+ Update, I analyze current development conditions and offer the following takeaways:

- How senior living companies are getting “smarter” with new projects

- Development implications from transaction replacement cost dynamics

- How and when new development activity might return

Ebb and flow on replacement costs, conversations ‘starting to change’

In 2026, senior living development is still relatively frozen.

In the third quarter of 2025, occupied senior housing units increased from roughly 630,000 to nearly 635,000 units in the fourth quarter. Across 31 NIC Primary Markets tracked by NIC MAP, occupied units increased by approximately 20,000 in 2025, a 3% increase compared to 2024.

But there are signs that could change soon thanks to evolving pricing for M&A in relation to development. In 2026, there are deals pricing above replacement, “sometimes materially so,” JLL Senior Managing Director and Co-leader of Senior Housing Jay Wagner told me this week. So far, those deals are limited to primary markets that carry high average occupancy and revenue. And it’s no secret that projects with solid pro formas are still attractive to investors and capital partners. Belmont Village CEO Patricia Will said during the recent BUILD conference that “the rate that we can charge for the value that we deliver enables us to continue safely underwriting new developments.”

“Whether there are people at the other end of this who are willing to lend depends on whether it underwrites,” she said.

A larger issue is the current lack of investor equity for new projects. Due to that, the “bulk of the market” continues to trade “well below” replacement costs right now, Wagner said.

From a sample of 100 transactions handled by SLIB in 2025, “there may have been one” that traded above replacement costs, Saul said.

But, at the same time, construction debt financing conditions have “continued to improve” despite high construction and labor costs, both Saul and Wagner told me.

“It’s still far off, but it is starting to change because development is inevitably getting into the conversation now,” Saul told me.

Any uptick in development is directly tied to existing property values, construction costs and lender appetite.

“It will not be until performing assets located in top markets have occupancy and cash flow that results in values starting to exceed or at least be closer to replacement costs will we start to see development pick up,” Saul told me.

These conflicting conditions are still largely encouraging because it shows that development is at least back in finance-related conversations and in some cases, certain transactions are now indeed trading above replacement costs.

Investors, operators must be ‘more diligent’ to develop new

Getting development done today takes more front-end work, from dealing with trouble accessing construction debt to tricky construction and labor costs threatening project plans.

Construction costs in early 2026 are similar to the levels the Weitz Company reported last year, the first edition of its Senior Living Construction Costs report shows from earlier this week.

To get projects done in 2026 and beyond, development companies and operators must be “more diligent” in finding the right market, Saul told me.

“Many are waiting for it to be cost effective and some are waiting for it to be market-driven,” Saul added. “If costs weren’t a factor, then you could build it and wait for the demographics to catch up.”

But the existing demographic “wave” at the industry’s doorstep won’t wait on capital markets to stomach riskier construction financing. These conditions require taking on more risk: jump in now to be first capitalizing on demand, or hold until market conditions demand development.

I look at operators including Experience Senior Living and Charter Senior Living, two companies that have undertaken past development. Charter has recently targeted tertiary-market development, and Experience has targeted primary market development in Washington, D.C., and Denver, both metro areas that have seen continued growth despite a development dearth.

These are both viable but contrasting strategies through chasing primary market demand or wading into tertiary market opportunities where competition is lighter and deals can work based on purpose-built community designs.

Operators like Charter and Cedarhurst Senior Living continue to move with agility in less populous markets. In December of last year, Cedarhurst entered Iowa with its first planned community that’s set to open in 2027. For these two operators, tertiary markets are one of the few places where costs, land availability and rental rates can succeed.

Other operators are focusing on growth within statewide networks, including Kingsbury Living, which opened its first $28 million community in Lancaster, Ohio last fall. Another Midwest-based operator, Silver Birch Living, started its first Ohio development last year as the company has its sights set on multiple new, affordable senior living communities in Ohio in the coming years, CEO Jo Ellen Bleavins told me in 2024.

“When the spigot does turn back on, the deals that will get done will be with experienced groups that have long standing capital relationships on the equity side,” Berkadia Seniors Housing & Healthcare Managing Director Cody Tremper told me.

These more targeted efforts in development show that development is possible in a challenging time, but requires more narrow project designs and some past development experience. Those that keep their development teams together, regardless of if there are shovels in the ground or not, will also be ahead of groups that disband development efforts altogether.

“A lot of these groups are now just starting to shift back and start thinking about it,” Wagner said of development prospects in 2026.

NIC data shows the average project takes approximately 29 months to complete, meaning that projects starting today most likely won’t open before next year or 2028, Zahraoui wrote.

A “broader shift” in senior living development could come “roughly two to three years away,” he said. That’s due to longer construction timelines, higher cost of capital and more strict underwriting, he told me.

“The biggest challenge is restoring development margins. Feasibility remains somewhat a challenge. Until project economics consistently compensate for construction risk, development will likely remain constrained,” Zahraoui told me.

So when senior living development returns, I’m confident it will be a targeted effort that’s led by strong operators less concerned about swinging for the fences in a home run derby, and more focused on making steady, repeated contact in 2026.

The post Senior Living Industry Gets ‘Smarter’ About Development While Waiting for Next Supply Cycle appeared first on Senior Housing News.

Popular Products

-

Cable Organizer Box for Desk & Outlet

Cable Organizer Box for Desk & Outlet$118.99$69.78 -

PVC Non-Slip Bathtub Mat with Suction...

PVC Non-Slip Bathtub Mat with Suction...$103.99$71.78 -

Adjustable Plug-in LED Night Light

Adjustable Plug-in LED Night Light$61.56$30.78 -

BroadLink RM4C Mini Smart Wi-Fi Unive...

BroadLink RM4C Mini Smart Wi-Fi Unive...$118.99$22.78 -

Echo Hub Smart Home Control Panel wit...

Echo Hub Smart Home Control Panel wit...$532.99$361.78