Dave Ramsey Says It Plainly: “i’m So Sorry To Whoever Sold You That Whole Life Policy”

Quick Read

-

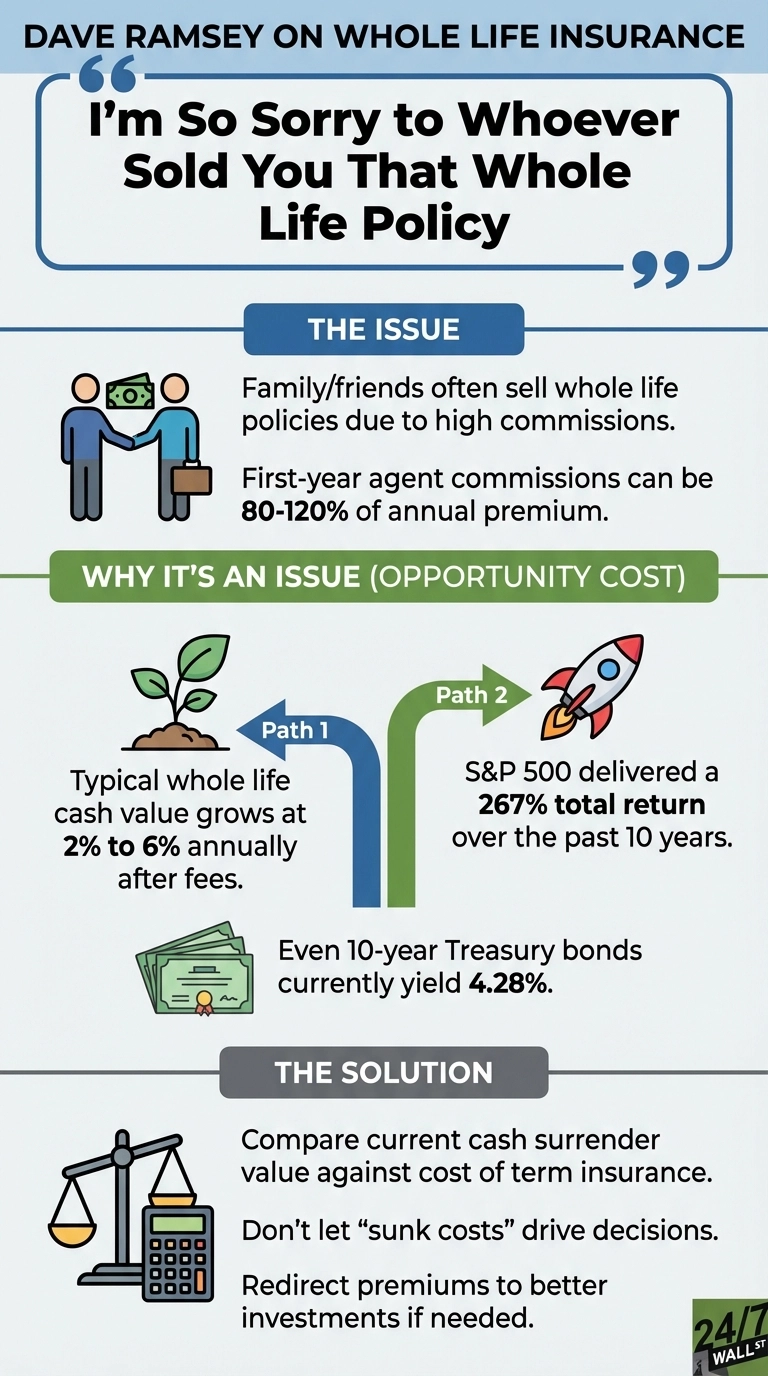

The S&P 500 (SPY) returned 267% over the past 10 years. Whole life cash value grows at 2-6% annually after fees.

-

Whole life agents earn 80-120% first-year commissions on annual premiums. This incentive drives sales to family despite S&P 500 underperformance.

- Are you ahead, or behind on retirement? SmartAsset's free tool can match you with a financial advisor in minutes to help you answer that today. Each advisor has been carefully vetted, and must act in your best interests. Don't waste another minute; learn more here.(Sponsor)

On a recent episode of The Dave Ramsey Show, caller Crystal revealed she had paid into a whole life insurance policy for 10 years after a family friend sold it to her. Ramsey’s response was direct, expressing regret about the sale. When he asked who sold it, Crystal confirmed it was a family friend. Ramsey noted the pattern of family members and friends selling these policies to their personal networks.

His commentary highlighted recruiting tactics common in the insurance industry, where newly licensed agents often target their personal connections.

Where Ramsey Gets It Right

The commission structure explains why newly licensed agents target their personal networks. First-year commissions on whole life policies typically range from 80% to 120% of the annual premium. This creates a powerful incentive to sell to people who trust you, even when the product doesn’t fit their needs.

The opportunity cost becomes staggering when you examine what Crystal gave up. While whole life cash value typically grows at 2% to 6% annually after fees, the S&P 500 delivered a 267% total return over the past 10 years. That difference represents the wealth Crystal sacrificed by choosing whole life over a simple index fund strategy.

Crystal didn’t need to take stock market risk to beat whole life returns. Even conservative investors choosing 10-year Treasury bonds at 4.28% would have built more wealth with zero market volatility, proving that whole life underperforms even the safest alternatives available to her.

This infographic highlights Dave Ramsey’s strong critique of whole life insurance, outlining the financial disadvantages and offering practical solutions. It contrasts the modest returns of whole life policies with the significantly higher performance of market investments and current Treasury bond yields.The Missing Context

Ramsey’s criticism omits one legitimate use case: high-net-worth individuals facing estate tax liability. For households with estates exceeding the federal exemption threshold, permanent life insurance can provide tax-free death benefits to cover estate taxes. But Crystal’s situation doesn’t suggest this applies.

The advice also assumes Crystal still needs life insurance. If her dependents have aged out or her financial situation changed, she may not need any coverage at all.

What Crystal Should Do

If Crystal still needs death benefit protection, she should compare her current cash surrender value against the cost of term insurance for her remaining coverage needs. The emotional difficulty of walking away from 10 years of payments is real, but sunk costs shouldn’t drive future decisions. The question isn’t what she’s already paid, it’s whether continuing the policy serves her financial goals better than surrendering it and redirecting those premiums elsewhere.

Ramsey’s broader point stands: mixing family relationships with commission-based financial products rarely ends well for the buyer.

If You have $500,000 Saved, Retirement Could Be Closer Than You Think (sponsor)

Retirement can be daunting, but it doesn’t need to be. Imagine having an expert in your corner to help you with your financial goals. Someone to help you determine if you’re ahead, behind, or right on track. With SmartAsset, that’s not just a dream—it’s reality. This free tool connects you with pre-screened financial advisors who work in your best interests. It’s quick, it’s easy, so take the leap today and start planning smarter! Don’t waste another minute; get started right here and help your retirement dreams become a retirement reality. (sponsor)

The post Dave Ramsey Says It Plainly: “I’m So Sorry to Whoever Sold You That Whole Life Policy” appeared first on 24/7 Wall St..

Popular Products

-

Fireproof Document Bag with Zipper Cl...

Fireproof Document Bag with Zipper Cl...$60.87$31.78 -

Acrylic Desktop File Organizer with 5...

Acrylic Desktop File Organizer with 5...$100.99$69.78 -

Child Safety Cabinet Locks - Set of 6

Child Safety Cabinet Locks - Set of 6$83.56$41.78 -

Travel Safe Lock Box with 4-Digit Cod...

Travel Safe Lock Box with 4-Digit Cod...$146.99$78.78 -

Dual Laser Engraver

Dual Laser Engraver$5,068.99$3034.78