If Your 401(k) Hits $1 Million By 35, Do You Need To Keep Saving For Retirement?

Key Points

-

$1M invested at age 35 grows to $2.2M by 45 or $4.7M by 55 at 8% annual returns.

-

A 3.7% withdrawal rate provides $79K annual income at 45 or $172K at 55.

-

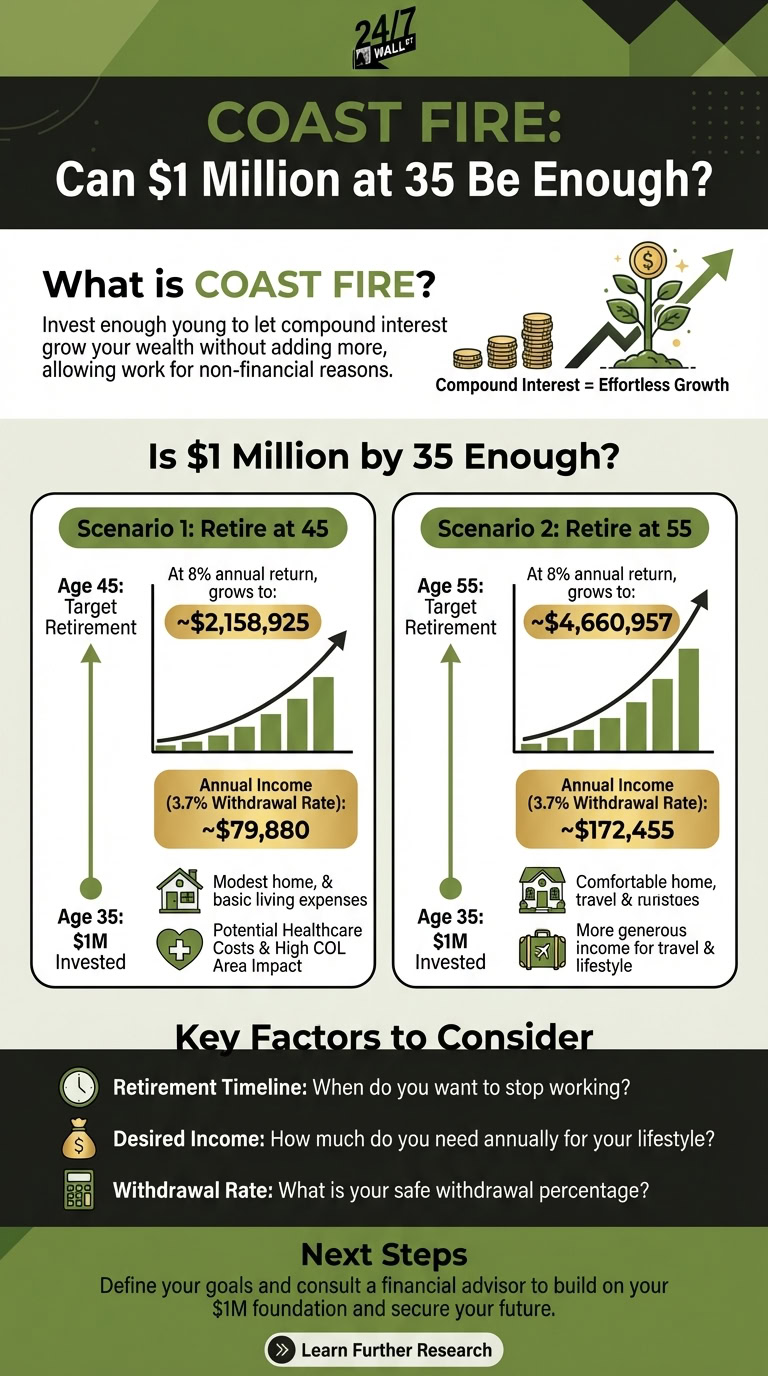

COAST FIRE lets compound interest grow wealth without additional contributions.

- If you’re focused on picking the right stocks and ETFs you may be missing the bigger picture: retirement income. That is exactly what The Definitive Guide to Retirement Income was created to solve, and it’s free today. Read more here

Saving a lot of money at a young age can set you up for future financial success. In fact, if you have a lot of money invested when you are young, compound interest alone can allow that money to grow and make you wealthy without you the need for you to make any additional contributions to your investment accounts.

This is often referred to as a lifestyle called COAST FIRE, which occurs when you have invested enough to sit back and let your investments grow and work for non-financial reasons.

The question, though, is just how much do you need to have saved to make that happen? If you have $1 million invested by 35, can you stop saving for retirement and still have the money you need to leave work and enjoy your life?

Is $1 million by 35 enough to coast on your investments?

If you have saved $1 million by 35, you may be able to coast on your investments without putting more money into your accounts — but a lot depends on factors like when you want to retire and how much you want to spend each year.

Let’s say that you were hoping to retire by age 45. If your $1 million investment earned an 8% average annual return for the next decade, you’d find yourself with around $2,158,925.00 by your target retirement date. At a safe 3.7% withdrawal rate, you’d have around $79,880.23 to live on.

That may be enough, but it very likely wouldn’t be if you lived in a high-cost-of-living area or were used to spending more while working. You’d also need to pay for health insurance if you left work before you became eligible for Medicare, and that could eat up a good amount of your money.

Now, if you were OK with working until 55, on the other hand, then your $1 million would grow into $4,660,957.14. This would provide you with a more generous $172,455 in income. Again, though, you’ll have to decide if that’s enough to travel, fund healthcare, and last you throughout your later years.

Compound interest can work for you — but you need to understand your goals

Compound interest is undoubtedly powerful, and the more you have invested at a younger age, the more powerful it is. Once you have a generously sized nest egg, your returns can be reinvested and your balance will grow each year. Your money will work hard for you, and this will allow your money to grow effortlessly.

However, that doesn’t necessarily mean that you don’t have to continue to save as a lot depends on what your goals are. You should determine:

- Your timeline for retirement

- The amount of income that you need to fund your expenses once you have stopped working

- What withdrawal rate you’ve decided on

Based on these factors, you can decide how much you actually need to contribute to your accounts over time.

You can also work with a financial advisor to help you answer these questions so you can build on the solid foundation you’ve created with your $1 million nest egg and ensure that you have the ability to create the life you want in the future.

Released: The Ultimate Guide To Retirement Income (sponsor)

Most investors spend years learning how to pick good stocks and funds. Far fewer have a clear plan for turning those investments into a reliable retirement paycheck. The truth is, the transition from “building wealth” to “living on wealth” is one of the most overlooked risks facing successful investors in their 50s, 60s and 70s.

That is exactly what The Definitive Guide to Retirement Income was created to solve. It’s a free guide that outlines the straightforward math and strategies you need to convert your investments to income. Learn more here.

The post If Your 401(k) Hits $1 Million By 35, Do You Need to Keep Saving for Retirement? appeared first on 24/7 Wall St..

Popular Products

-

Gas Detector Meter

Gas Detector Meter$311.56$155.78 -

Fingerprint Digital Lock

Fingerprint Digital Lock$328.99$230.78 -

Double Door Safe Box for Home & Office

Double Door Safe Box for Home & Office$449.99$313.78 -

Biometric Pistol Case

Biometric Pistol Case$224.99$156.78 -

Bluetooth 5.0 TPMS Tire Pressure Monitor

Bluetooth 5.0 TPMS Tire Pressure Monitor$60.99$41.78