Insurance Brokers Extend Monday's Plunge On Fears Ai Is Coming For Them Next

Insurance Brokers Extend Monday's Plunge On Fears AI Is Coming For Them Next

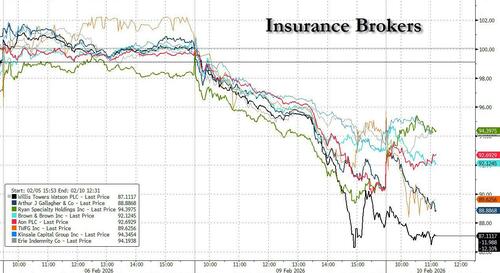

The rolling AI disruption wave, which most recently crushed the software sector, slammed insurance brokers on Monday with losses extending on Tuesday, as most names in the space slumped following reports from Reinsurance News and others that OpenAI approved the first AI insurance app on ChatGPT, built by Spanish digital insurer Tuio.

The insurance brokerage space dived 9% on average on Monday in reaction to the news: among the worst performers were Willis Towers Watson which experienced the steepest decline, its shares falling 13%. Arthur J. Gallagher dropped 9.4%, while Aon shed 8.5%. Ryan Specialty and Brown & Brown fell 8% and 7% respectively, with Marsh & McLennan also down 7%. Insurer AIG saw a more modest decline of 2%.

The market reaction came after OpenAI announced that Tuio’s app, powered by WaniWani’s AI distribution infrastructure, allows ChatGPT users to receive personalized home insurance quotes directly through conversation, with purchasing capabilities coming soon. This marks the first time an insurance provider can distribute products and offer quotes directly within an AI platform.

According to OpenAI, the new capability removes traditional friction points in insurance purchasing by eliminating forms, calls, and intermediaries. Tuio’s AI app collects relevant information through natural conversation and returns personalized quotes from regulated carriers in real time, Investing.com reported.

Some investors expressed confusion about the market reaction, questioning why commercial insurance brokers were so heavily impacted when the current application focuses on home insurance. Some argued that insurance brokers dealing with specialty products might be better insulated due to the complexity of those offerings.

Banks promptly came to the sector's defense with Goldman underscoring the investor confusion, and writing that “the immediate feedback still is a degree on confusion & the top question is 'Why would this primarily impact the brokers (who primarily do commercial .. think there's only home insurance at the majors for high net worth)' .. with a few arguing it's 1) more negative for personal insurance carriers given greater price transparency/shopping/competition, and 2) Insurance brokers dealing in more specialty products should be better insulated given complexity.

UBS also was quick to defend, with analyst Brian Meredith saying he remains a buyer of the brokers and "views the pullback as an attractive entry point for his preferred broker names: Marsh, Goosehead Insurance and Willis Towers Watson."

Meredith added that concerns around broker disintermediation have been around for decades, with insurance brokers still the principal means of distribution for commercial insurance products, and independent/captive agents accounting for more than two-thirds of personal lines insurance distribution. Brian said brokers remain essential intermediaries for a complex purchasing decision.

He continues to favor the insurance brokers in 2026 as he believes growth expectations have bottomed with potential upside in a good economic environment. "Valuations are attractive on a relative and absolute basis and reflect a "soft" market."

Then again, as Goldman concludes, there's certainly a degree of 'don't fight the narrative' .. and this is all very fresh/fluid at the moment.”

And if the ongoing rout in the software space is any indication, there is much more pain to come.

Popular Products

-

Large Wall Calendar Planner

Large Wall Calendar Planner$55.76$27.78 -

Magnifying Glass Light 3X Ultra-Thin ...

Magnifying Glass Light 3X Ultra-Thin ...$23.99$15.78 -

Anti-Glare Blue Light Laptop Privacy ...

Anti-Glare Blue Light Laptop Privacy ...$51.99$35.78 -

Ultra-Thin Webcam Privacy Cover Slide...

Ultra-Thin Webcam Privacy Cover Slide...$37.99$25.78 -

USB Rechargeable LED Pen Light with P...

USB Rechargeable LED Pen Light with P...$41.99$28.78