Yes, Your Car Insurance Is Getting Less Expensive

The Trump Administration’s tariffs are making new cars more expensive to buy and old ones more expensive to maintain, but there’s at least some good news about affordability. After two years of spikes, insurance rates decreased in 2025, according to a new report from Insurify, an online insurance brokerage. But that only applied to some states.

Based on analysis of more than 197 million rates from partner insurance companies for drivers in the United States, Insurify found that the average annual full-coverage premium fell 6% in 2025, to $2,144. The company tracked price decreases in 39 of the 50 states (although Alaska was excluded due to a small sample size), with eight seeing a drop of 15% or more. Wyoming, Iowa, and Arkansas had the largest cuts, at more than 20%.

InsurifyThat’s a welcome change for drivers, who saw average insurance rates increase 46% from 2022 to 2024, according to Insurify. The company suggests that was largely due to the increase in risky driving behavior during the pandemic. Other analysis has found that average claim rates also increased due to higher repair costs for tech-laden new vehicles.

Insurers have now accumulated enough dough from elevated premiums to absorb tariff-driven costs without further price hikes, according to Insurify, with many cutting rates to attract and retain new customers. However, that isn’t the case nationwide.

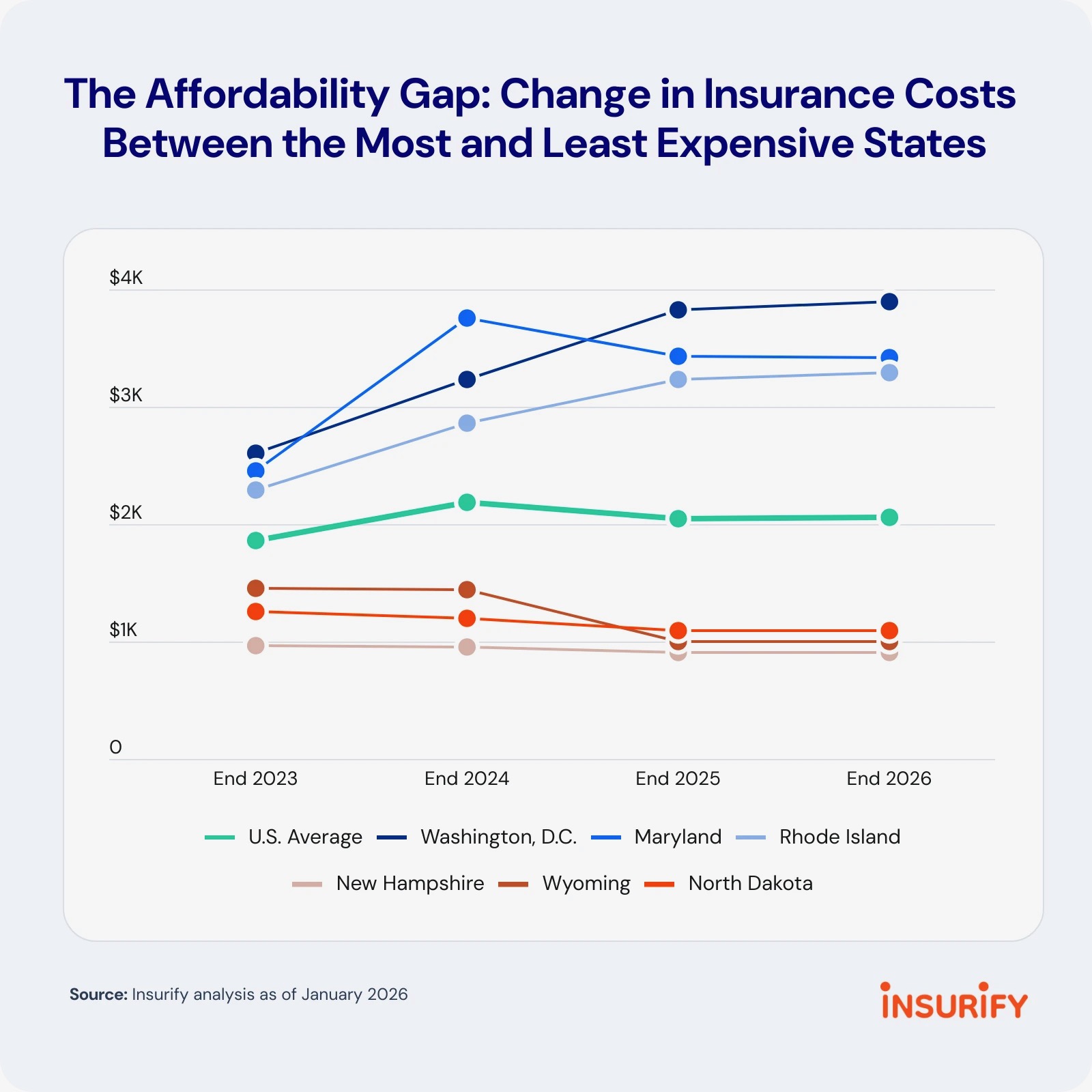

While many states saw average-premium cuts in 2025, three states and the District of Columbia had significant increases. Rates went up 20% in New Jersey, 13% in Rhode Island, and 12% in Michigan. D.C.’s 18% increase saddled drivers with the highest average full-coverage car insurance rates nationwide. At $4,017, drivers in the nation’s capital paid nearly twice the national average in 2025.

InsurifyRate changes tended to follow existing cost trends, with insurance tending to get more expensive in states that already had higher rates and less expensive in states with lower baseline rates. Insurify expects that to continue in 2026, widening the gap between the states where insurance is the most and least expensive. That will effectively freeze national average rates, with just a 1% increase to $2,158 for an annual full-coverage premium expected.

Insurify also looked at rates for specific models and found decreases in most cases. Of the 50 top-quoted models surveyed, 48 saw rate cuts in 2025. The exceptions were the Tesla Model S and Model X, which saw rate increases of 9% and 7%, respectively.

Got a news tip? Let us know at tips@thedrive.com!

The post Yes, Your Car Insurance Is Getting Less Expensive appeared first on The Drive.

Popular Products

-

Large Wall Calendar Planner

Large Wall Calendar Planner$55.76$27.78 -

Magnifying Glass Light 3X Ultra-Thin ...

Magnifying Glass Light 3X Ultra-Thin ...$23.99$15.78 -

Anti-Glare Blue Light Laptop Privacy ...

Anti-Glare Blue Light Laptop Privacy ...$51.99$35.78 -

Ultra-Thin Webcam Privacy Cover Slide...

Ultra-Thin Webcam Privacy Cover Slide...$37.99$25.78 -

USB Rechargeable LED Pen Light with P...

USB Rechargeable LED Pen Light with P...$41.99$28.78