Colgate-palmolive Dividend Scorecard: How Does The 2.6% Yield Stack Up?

Quick Read

-

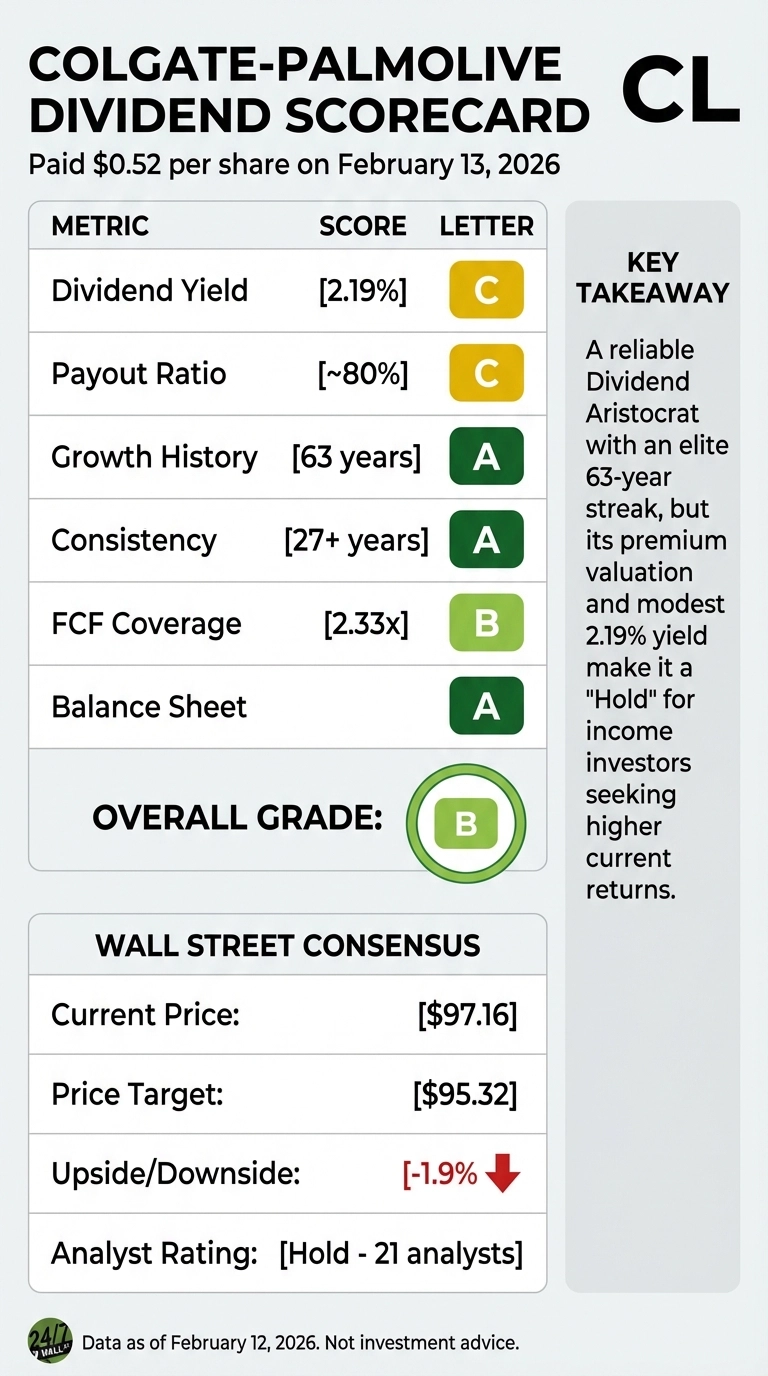

Colgate-Palmolive (CL) paid $0.52 per share on February 13, extending its 63-year dividend increase streak.

-

Colgate’s 2.19% yield trails Kimberly-Clark at 4.76% and P&G at 2.63%.

-

Colgate trades at 36x earnings as revenue growth slowed to 1.4% in 2025 from 8.3% in 2023.

- Are you ahead, or behind on retirement? SmartAsset's free tool can match you with a financial advisor in minutes to help you answer that today. Each advisor has been carefully vetted, and must act in your best interests. Don't waste another minute; learn more here.(Sponsor)

Colgate-Palmolive just sent $0.52 per share to investors that will land on February 13, 2026, marking another quarterly payment in the consumer goods giant’s 63-year dividend increase streak. That consistency places Colgate among an elite group of Dividend Aristocrats, but the real question for income investors is whether this 2.19% yield justifies the premium valuation—and how it stacks up against household name peers also competing for dividend portfolios.

The Dividend Scorecard: How CL Measures Up

Colgate’s current quarterly dividend of $0.52 translates to an annualized $2.06 per share, yielding just over 2% at current prices near $97.16. That yield sits below several direct competitors: Kimberly-Clark offers 4.76%, and even Procter & Gamble provides 2.63%.

The lower yield reflects Colgate’s premium valuation. Trading at 36x trailing earnings, the stock commands a significant multiple above peers like Kimberly-Clark at 22x. Investors are effectively paying for reliability and brand strength rather than income generation alone.

Growth vs. Income: The Aristocrat Trade-Off

Colgate increased its dividend 4% in early 2025, moving from $0.50 to $0.52 per quarter. That growth rate aligns with peers: PepsiCo announced a 5% increase and Coca-Cola lifted its dividend 5.15% year-over-year. The consistency matters more than the magnitude—Colgate hasn’t missed a beat in six decades.

But growth rates tell only part of the story. Colgate’s payout ratio based on fiscal 2025 net income of $2.13 billion and an annualized dividend run rate near $1.7 billion suggests a sustainable 80% payout. Compare that to PepsiCo, which paid out $8.8 billion in dividends against $8.24 billion in net income—a 107% payout ratio that relies heavily on operating cash flow rather than reported earnings.

Earnings Quality and Coverage Capacity

Colgate generated $4.35 billion in operating income and $3.96 billion in EBITDA for fiscal 2025, providing ample cushion for dividend obligations. The 21% operating margin demonstrates pricing power in oral care and personal products, even as revenue growth slowed to 1.4% in 2025 from 8.3% in 2023.

Procter & Gamble shows similar stability with $20.45 billion in operating income on $84.28 billion in revenue, though its net income growth of 7.4% year-over-year outpaced Colgate’s more modest gains. Meanwhile, Coca-Cola delivered exceptional earnings growth of 23.3%, with net income reaching $13.1 billion—the highest in a decade.

Total Return Context: Price Matters

Dividend yield alone misses the full picture. Colgate shares have climbed 23.71% year-to-date and 14.75% over the past year, adding meaningful capital appreciation to that 2.19% yield. Total return approaches 17% annually when dividends reinvest at these levels.

Compare that to Kimberly-Clark, down 14.89% over the past year despite its 4.76% yield. Higher yields often signal market skepticism about growth prospects or earnings stability. PepsiCo has delivered 22.68% price appreciation over the past year, while Coca-Cola gained 19.53%.

The Valuation Premium: Justified or Stretched?

Colgate’s 36x P/E ratio and 3.6 PEG ratio suggest the market prices in considerable optimism about future growth. The 3.78x price-to-sales ratio exceeds most consumer staples peers, though it trails PepsiCo at 2.46x when adjusted for scale.

That premium reflects brand strength—Colgate commands dominant market share in oral care globally—and the reliability of that 63-year dividend streak. But it also means less room for error. Any stumble in emerging market growth or margin pressure from input costs could trigger multiple compression faster than lower-valued peers.

Peer Comparison: Where CL Fits

Among household products giants, Colgate occupies middle ground. It lacks the diversification of Procter & Gamble’s $84 billion revenue base spanning beauty, grooming, and home care. And it trails the scale of PepsiCo’s $93.9 billion food and beverage empire.

What Colgate offers is focus. Oral care, personal care, and pet nutrition provide concentrated exposure to consumer habits that prove resilient through economic cycles. That focus drives 60.1% gross margins and consistent cash generation, even when revenue growth moderates.

The Dividend Aristocrat Premium

Sixty-three consecutive years of dividend increases carry weight. That streak survived the 1970s stagflation, the 2008 financial crisis, and the 2020 pandemic. It signals management discipline, balance sheet strength, and a shareholder-first culture that transcends economic cycles.

But aristocrat status doesn’t guarantee future returns. Some dividend aristocrats have maintained impressive streaks while shares languished. The dividend provides income certainty; price appreciation requires earnings growth and multiple expansion.

Colgate’s $77 billion market cap and 85.8% institutional ownership reflect broad acceptance of its premium valuation. Analyst targets near $95.32 suggest limited upside from current levels around $97, though consensus ratings lean positive with 6 strong buy and 7 buy ratings against 8 holds.

Colgate-Palmolive (CL) earns an overall B grade on its dividend scorecard as of February 12, 2026, driven by strong growth history and balance sheet, despite a modest dividend yield and ‘Hold’ analyst consensus.What This Dividend Payment Signals

The $0.52 quarterly payment represents business as usual for Colgate—no surprises, no acceleration, no warning signs. That consistency matters for retirees and income-focused portfolios where predictability trumps growth.

For investors choosing between consumer staples dividends, the decision hinges on priorities. Those seeking maximum current income gravitate toward higher-yielding peers. Those prioritizing total return might favor PepsiCo’s combination of 3.37% yield and stronger price momentum. Those valuing defensive stability with modest growth accept Colgate’s 2.19% yield as the price of admission to a proven dividend aristocrat.

The next dividend increase will likely arrive in early 2027, continuing the pattern of Q1 adjustments. Barring significant operational disruption, that increase should land in the 3-5% range based on recent history. For a stock trading at 36x earnings with single-digit revenue growth, that’s the formula: steady, predictable, unremarkable—and for many dividend investors, exactly what they’re paying for.

Finally! Access 25+ Cryptocurrencies The Easy Way

After years of waiting for a good option, SoFi now offers access to major cryptocurrencies like Bitcoin, Ethereum, and Solana, along with more than 25 total digital assets. What stands out isn’t just the selection, it’s the integration.

You don’t need a separate app, a new login, or a different funding source. Crypto lives next to the rest of your portfolio, which makes position sizing, rebalancing, and capital deployment far easier for investors who actively manage risk.

If you’re an active investor who wants crypto exposure without stepping outside a regulated financial ecosystem, SoFi is a top choice. Get started here.

The post Colgate-Palmolive Dividend Scorecard: How Does the 2.6% Yield Stack Up? appeared first on 24/7 Wall St..

Popular Products

-

Oval Cat Scratcher Pad Bowl Nest and ...

Oval Cat Scratcher Pad Bowl Nest and ...$55.99$38.78 -

Dog Tuxedo Suit with Bow Tie and Leash

Dog Tuxedo Suit with Bow Tie and Leash$68.99$47.78 -

Washable Lint Remover Roller for Pet ...

Washable Lint Remover Roller for Pet ...$40.99$27.78 -

Automatic Rolling Cat Toy Ball for Pe...

Automatic Rolling Cat Toy Ball for Pe...$47.99$32.78 -

Walking Robot Plush Puppy Dog Toy

Walking Robot Plush Puppy Dog Toy$81.99$56.78