New York City, Phoenix, Miami Were Top Markets For Senior Housing Transactions In 2025

New York City, Phoenix, Arizona, and Miami were the top-three locales for senior housing investments during the first three quarters of this year, according to a new NIC report.

In a report released Dec. 11, NIC researchers detailed the geography of the more than $16.3 billion senior housing and care transactions in 2025. Senior housing accounted for more than $10.3 billion of that total.

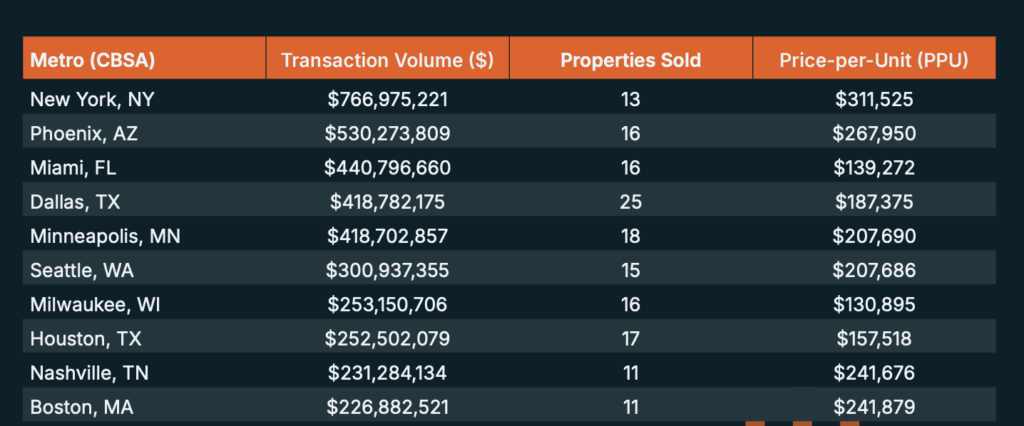

In New York City, around $766 million changed hands across 13 properties, selling at a price-per-unit of $311,525, according to the NIC report. Dealmakers in Phoenix, Arizona, notched$530 million in transaction volume with 16 properties sold at a price-per-unit of $267,950, followed by Miami with $440 million in transaction volume through 16 properties sold at a price-per-unit of $139,272.

Image courtesy NIC MAP Image courtesy NIC MAPIn the first three quarters of 2025, the average deal price-per-unit rose to $175,000, a 43% increase versus the same period in 2024 and marking six months of continuous growth. More than 1,000 properties changed hands, a 7% increase from the previous year.

“The data paints a clear picture of a market that’s regained its footing,” Arick Morton, CEO of NIC MAP, said in a press release. “Transaction activity, pricing momentum, and capital interest are all accelerating. Senior housing has emerged from a correction period stronger and more attractive to investors seeking stable, long-term growth opportunities.”

Based on the amount of investments and transactions taking place, Morton believes the industry is poised for strength in 2026.

“Investor behavior today reflects conviction in the sector’s fundamentals,” Morton continued. “As demographic demand accelerates and operating metrics improve, senior housing remains a compelling opportunity in the broader commercial real estate landscape. The transaction data tells us where investors are preparing from growth. Now we need development to follow because we simply don’t have enough senior housing in the pipeline.”

While the investor pool continues to broaden, there are still concerns about a projected shortfall. Based on NIC MAP data, the U.S. is facing a 550,000-unit shortfall in senior housing by 2030, representing a $275 billion investment shortage, according to the release. To address it, the industry will need to “more than triple its current development pace to meet surging demand from the 80+ population.”

The post New York City, Phoenix, Miami Were Top Markets for Senior Housing Transactions in 2025 appeared first on Senior Housing News.

Popular Products

-

Smart Bluetooth Aroma Diffuser

Smart Bluetooth Aroma Diffuser$585.56$292.87 -

WiFi Smart Video Doorbell Camera with...

WiFi Smart Video Doorbell Camera with...$61.56$30.78 -

Wireless Waterproof Smart Doorbell wi...

Wireless Waterproof Smart Doorbell wi...$20.99$13.78 -

Wireless Remote Button Pusher for Hom...

Wireless Remote Button Pusher for Hom...$65.99$45.78 -

Digital Coffee Cup Warmer with Temp D...

Digital Coffee Cup Warmer with Temp D...$88.99$61.78